Posted by: Pdfprep

Post Date: May 14, 2021

Refer to the Exhibit.

A business has three non-current assets.

(i) Asset 1 will be used to manufacture components over a 4 year period, after which it will be scrapped; the total contract is for 1 million components, to be produced in different quantities each year.

(ii) Asset 2 is a motor car for a director; it is expected to be kept for 3 years, and will travel 20,000 miles each year.

(iii) Asset 3 is a mobile truck used for transporting goods around the factory; it is expected to be kept for 20 years.

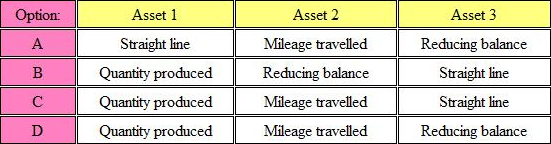

Which one of the following combinations of depreciation methods, would be most reasonable for the above three assets?

The answer is:

A . Option A

B . Option B

C . Option C

D . Option D

Answer: B

Leave a Reply