Posted by: Pdfprep

Post Date: April 24, 2021

In Country X, trading losses in any year can be carried back and set off against trading profits in the previous year, with any unrelieved losses carried forward to set against the first available trade profits in future years.

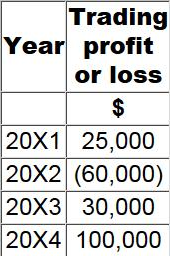

GH had the following taxable profits and losses in years 20X1 to 20X4:

What are the taxable profits for 20X4, assuming the most efficient use of the loss is made?

A . $65,000

B . $95,000

C . $100,000

D . $70,000

Answer: B

Leave a Reply