CORRECT TEXT

The following information is extracted from QQ’s statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

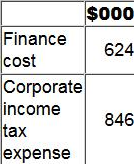

The following information if included within QQ’s statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease.

QQ includes finance lease interest within financing activities on its statement of cash flows.

QQ is preparing its statement of cash flows for the year ended 31 March 20X2.

What cash outflow figure should be included for corporate income tax paid within the cash flow from operating activities section of the statement?

Give your answer to the nearest $000.

Answer: $753

Leave a Reply